The IRS uses Notice CP163 to remind taxpayers of their past due taxes. Form 941, the Employee Withholding form, is usually involved in these notices.

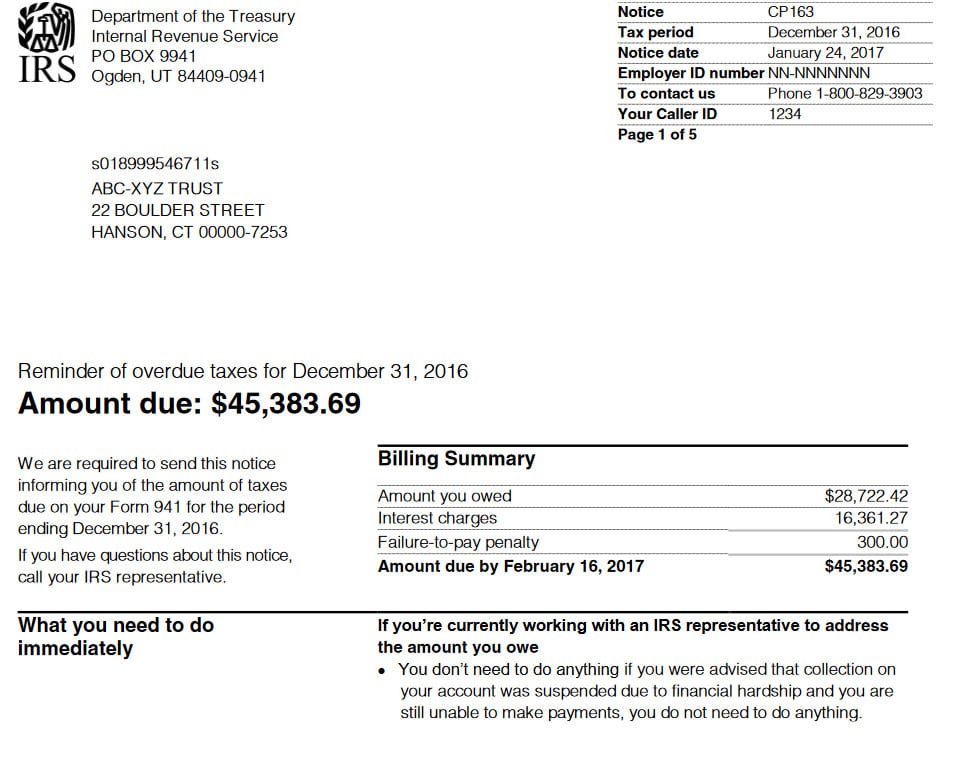

This is what the notice looks like:

These taxes involve Employee Withholding, and they are not dischargeable in bankruptcy. The amounts will likely be assessed against all Responsible Persons in the business, personally. Unless the business ceases the IRS has two avenues of pursuing the taxes.

If the business remains on-going they will pursue the business liability against the business. If the business has closed the IRS will likely pursue the “Trust Fund Recovery Penalty” against ALL “Responsible Parties”.

The major problem businesses face is that the amount of penalties & interest charged by the IRS are so enormous, they force the closing of the business. If unable to pay, this may be a viable strategy. If this happens, the IRS will likely seek the “Trust Fund Recovery Penalty” against ALL “Responsible Parties”. If so, EACH “Responsible Party” will have to make arrangement for personal resolution. But, if the circumstances are good, an Offer in Compromise may be recommended.

What is My First Step?

If you received a letter or notice, a decision has to be made. Do you feel confident to handle this situation on your own? If it is a simple issue and you already know the answer, call or write them. If the issue is more complicated, you need to hire a Certified Tax Resolution Specialist. The IRS or State will take full advantage of your lack of knowledge and experience. Call Tax Network USA today at 1(855) 225-1040 or fill out our contact form and Tax Network USA will contact you ASAP for help with your all IRS tax issues.

What is Your Next Step?

The next step is to determine if the notice was sent in error. Do you have unfiled or incomplete returns? Do you have an outstanding tax liability?

Is There a Time Limit?

Yes, each letter or notice from the IRS or State will indicate a date that you MUST to contact them by. If you need more time, call the number on the notice or letter and request an extension. DO NOT ALLOW the time to expire without contacting them or hiring a representative to contact them for you. You can hire the Tax experts at Tax Network USA to represent you and make sure everything is taken care of correctly contact us now.

What You Don’t Want to Do!

What you don’t want to do is do nothing. Your tax problems will only get worse if you ignore them. If you cannot pay, there are a number of potential solutions available to those who are otherwise in compliance. In compliance means having all tax returns filed and any balances paid or on a payment plan. If you have outstanding debts or unfiled returns, you need to hire a Certified Tax Resolution Specialist.

Get Some Help

If you don’t know how to address the issue(s), have unfiled return/unpaid balances or just don’t feel confident, let the experts at Tax Network USA represent you. Work with our team of Certified Tax Resolution Specialists to resolve your issue(s) quickly. Best of all, you don’t have to talk to the IRS or State; we can speak on your behalf.

Call us at 1(855) 225-1040 or fill out our contact form and Tax Network USA will contact you ASAP for help with your all IRS tax issues.